Tax season. Those two words can mean different things to different people. For the UM Payroll Office, it means one thing…producing W-2 statements for employees.

Each January, between 7,000 and 8,000 W-2 forms are generated, printed, and mailed to employees. This process consumes a tremendous amount of paper in the form of special paper stock to print the W-2 form and special envelopes for mailing, not to mention the cost of postage for mailing the forms.

For several years, the university has wanted an online, self-service solution for W-2 forms that would allow employees to opt-in to receive their W-2 form electronically . As a result of our last SAP upgrade in April, 2011, the University was asked to participate as a pilot site for SAP’s online W-2 solution for the 2011 tax year. Now, after a successful pilot in 2011, all university employees may elect to receive their W-2 forms online for the 2012 tax year and beyond.

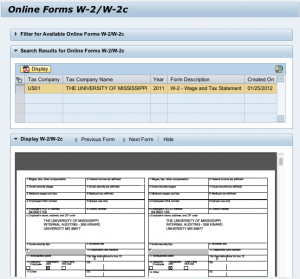

Two new options now appear on the Employee Self-Service area of myOleMiss. The first, “Online W-2 – Opt In,” is where employees can elect to receive their W-2 form electronically for tax year 2012 and beyond. The second, “Online W-2 – View Forms,” is where employees can view their W-2 forms for tax year 2012 and beyond. Each application has online help to assist employees in both opting-in and viewing their W-2 forms. Employees must opt-in to be able to receive their W-2 electronically.

Employees will be able to opt-in for the 2012 tax year beginning November 26, 2012, and continuing through January 20, 2013. The W-2 forms will be generated between January 20 and January 31, 2013, and once they have been generated, those who have elected to receive their forms online will be able to view their W-2 in myOleMiss.

Audrey Floyd, Manager of Payroll, is excited about rolling out this new feature to UM employees. “We issued over 7,000 W-2s last year. The reduction in paper use and postage costs would be significantly lowered if half of our employees take advantage of the online W-2 functionality. Other advantages include faster retrieval, secure electronic access from any location, and the ability to access forms from tax year 2012 forward. I would encourage all UM employees to take advantage of this new feature.”